Author

Author

|

Topic: Jump You Fuckers: Follow the bouncing 700 Billion (Read 24329 times) |

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Jump You Fuckers: Follow the bouncing 700 Billion

« on: 2008-10-06 22:13:23 » |

|

[Fritz]So where does it all the money go .... the opening article for context.

Now lets see if it is possible to follow the bouncing 700 billion dollars balls .... or not ....

Source: International Forcaster

Author: Bob Chapman

Date: 2008.09.24

The unbelievable breakdown in American lending standards, market instruments no more than a worthless pile of paper, note how market elitists are using the market crash to put pressure on Congress, the plan to bail out fraudsters, the vicious circle of printing more and more currency, more wiled speculation to come after a bailout,

As it turns out, all the foreign nations holding dollar-denominated foreign exchange surplus reserves in the form of treasury paper realized that we were going to inflate them into oblivion, what with all the bailouts and such, and it appears, well, that they all ran for the door at once, if you catch my drift. We wore out all the printing presses trying to cash in their bonds for them, and all we had left was a huge pile of treasury paper, which we decided to throw out of my helicopter instead of cash. They're in pretty big denominations, so the people should be quite impressed. In any case, we couldn't print any more Federal Reserve notes on account of the printing press issue, and besides, the notes wouldn't have been good for anything but heating fuel, "furnace fodder" if you will, so why go through all the expense to print more? We have to be fiscally responsible, you know. MM: Yeah, right. Gee, I know this may sound odd, but now that your helicopter's engines have shut down, I could swear that I hear -- could it be -- the sound of marching jackboots, doing a goose-step, in the background?

HP: Ahem, well, after Ben and I consulted with our Gestapo, oh, I mean our Department of Homeland Security, they decided to send in the foreign storm-troopers, er, our soldiers, as a follow-up to our helicopter drop. They were apparently concerned that there might be mass social upheaval, and possibly even a revolution, after the sheople, I mean our citizens, discovered that the treasury bills we just dropped were nothing but "worthless paper." Well, Ben, we better get going. We barely have time to pack and get ready to flee to our bunkers and safe-houses with the rest of our "comrades." Hey, see ya, wouldn't wanta be ya!!! Oh, and by the way: Sich Heil! MM: I have a bad feeling about this!

After over 40 years of financial reporting and analysis, we can say, without hesitation, that the 700 billion bailout plan proposed by Fed Chairman Buck-Busting Ben Bernanke and Treasury Secretary Hanky Panky Paulson, on behalf of the Caligula Administration, is the most abusive and piggish fascist scheme we have ever heard proposed. This is the living, freaking, end. We sit hear stunned and stupefied at the sheer arrogance of a corporatist, fascist plan, so saturated with moral hazard, that it can only be described, to use the words of Jean-Pierre Roth, president of the Swiss National Bank, in his description of the breakdown in American lending standards, as "unbelievable!"

First, note how the elitists have allowed the stock markets to crash over the past two days in order to put pressure on Congress to adopt their plan. They have withdrawn PPT support in an effort to stuff this plan down Congress's throat. And this pressure will continue until they get their way. This is what Congress gets for letting the Illuminati run our country. Now, they will have to face their constituents in a no-win situation. If they adopt the plan, they will be accused of bailing out the fraudsters, and of privatizing the profits from the sheople's hard work in evil elitist corporations, while socializing the losses from yet another bankers' Ponzi-scheme in the sheople as is their custom. If they don't adopt the plan, and as a result, the credit markets freeze up and the US economy goes down in flames, they will be blamed for that as well, even though that is our best solution at this point (i.e. purging the system of its excesses). The fact that our Congress has sat on their collective duffs and allowed this financial debacle to happen, when it was quite easily avoidable with even the slightest amount of regulation and oversight, gives you every reason to vote out every one of these reprobates and sociopaths ,which we like to refer to as "incumbent scum." The only exceptions to the coming ouster of incumbents, as far as we are concerned, are Ron Paul, and perhaps Senator Jim Bunning of Kentucky.

Congress appears to be balking, and rightly so, claiming that they need more time to deliberate over this situation, to ponder potential alternative plans, or at the very least to modify the current proposal to make it more palatable to voters, which is impossible, at least in our humble opinion. But is this just more posturing to make it look like they are not rolling over and playing dead for the elitists, or has Congress finally found their collective backbone? Only time will tell, but based on past experience, we aren't getting our hopes up.

These filthy Bosch Pigs want to give Paulson carte blanche to pay for toxic waste at its "hold-to-maturity" value with taxpayer funds, meaning you will pay par for crap that is worth pennies on the dollar. Then you, the taxpayer, will get paid back in hyper-inflated dollars on ever-deteriorating assets, with flagging real estate prices chipping away at their value without recovery for decades, meaning that your collateral on any of these no-down-payment, give-him-a-loan-if-he's-breathing mortgages will be impaired and next to useless in the event of default. And who is going to administer all these loans, and process the payments, and deal with defaults? And what types of toxic waste will be subject to the bailout? Will we be taking on defaulted credit default swaps, interest rate swaps, credit cards, corporate bonds, commercial paper and aircraft leases also? Will we solve the mortgage-backed securities problem only to be bitten in the butt by credit default and interest rate swaps, or other toxic paper that was equally steeped in fraud? Of course we will.

The most egregious part of the proposed bailout is that it allows Paulson to dole out the funds and deal with the toxic waste without any judicial oversight and with full immunity from any criminal prosecution. This means he can pay par with your hard-earned money, and then when it becomes clear that the cess-pool-paper is only worth a small fraction of par, he can pawn it off to his cronies at bargain basement prices, thus distributing any profits to the elitists as they see fit, and the American people can go spit in the wind.

And how is this elitist bailout bonanza going to benefit the taxpayers, or our economy? It isn't! In fact, it is going to exacerbate an already volatile situation. Thanks to free trade and globalization, the global economy has become a tripwire economy. One wrong move, and the claymores go off, taking out the entire global financial system in a blaze of shrapnel and glory. The whole house of fraudster cards, rife with trade and investment imbalances, then collapses and gets sucked into a gargantuan financial black hole. All it will take is one nation whose citizens are fed up with rampant inflation. They will have to break the dollar pegs, cash in their US treasury bonds, and absorb the excess amounts of their domestic currencies by purchasing them with the dollars received as proceeds from the sale of the treasury bonds. This strengthens their currency, thus moderating their inflationary problems, but then their exports suffer. Meanwhile, the dollar starts to decline, and everyone else is afraid that this decline will continue and threaten the value of their reserves. The mad dash for the front door begins, and not everyone can fit through at the same time. The dollar gets destroyed, along with the US economy, as the cash from dumped treasuries finds its way back to the US through purchases of US assets by the foreign nations that are looking desperately to dump their cash, thus creating hyperinflation on a Weimar scale. That is why the FTC is no longer publishing statistics regarding foreign investment in the US, to hide this problem from the public as the dollars start pouring in. Adding to global woes, the exporting nations, whose goods are now no longer competitively priced, go down with the USS Titanic.

The United States operates at a deficit, spending more money than we gained from our own production, and we need foreigners to finance our profligacy. In order to help us finance this deficit, these foreigners buy our treasury paper with the excess dollars they obtain from their trade with the US. They do this by having their central banks print more of their domestic currency to absorb the dollar forex which is flooding their economies due to trade imbalances with the US. Their central banks simply print more of their own currency, which is then used in currency exchanges to soak up that dollar forex. This process inflates their economies by dumping their own currency on their domestic markets while bidding up dollars which are then used to purchase treasuries. While those dollars are parked in treasuries, they do little harm to US citizens via inflation, although we do have to pay interest on them. The foreign nations then enjoy a competitive price on their exports to the US because of their artificially weakened currency, but at the expense of domestic inflation. This system perpetuates the trade imbalances, and the inflation in the foreign nations. Obviously, this cannot go on forever.

And now, all these wild, lunatic bailouts will threaten the entire world economy. Why? Because we are dumping more dollars into the world economy, devaluing our currency, and therefore the value of all these foreign-owned US treasury bonds. Imagine what will happen when 700 billion dollars, in cash, is dumped into the fraudster system. If the fraudsters start lending again, that means the fractional banking multiplier, which usually runs at 7 to 8 times reserves, will then generate five to six trillion dollars of new money and credit, an amount that would swamp the US and global financial systems even if the Fed shut off its money and credit spigot completely. And who would they lend all this money to? The overextended, totally broke, unemployed, underemployed sheople who are being hyper-inflated into oblivion? Of course not. It will be used for more wild speculation, and to produce more leverage, and more fraud, and more toxic waste, which will add yet more money and credit to our already waterlogged, or should we say dollar-logged, system.

And just because there are losses does not mean that this 700 billion will be absorbed by those losses. The money that was used to produce the assets which suffered those losses is still in the system, but not where the elitists wanted it to be parked. They are trying to get that money back, at your expense, through this bailout plan. Where is that money now? It is following a path from wherever the last seller of the toxic waste, before it went bad, spent or invested the proceeds from the sale of that toxic waste. Remember, these derivatives added nothing to the system. They are just a re-bundling of existing debt-type assets, with the proceeds being used to create more debt for more re-bundling, in what is truly a Ponzi-scheme, using the same money over and over again to create more debt. The only new money produced were the fees and commissions paid to do the re-bundling. What about the money that the current owner of the toxic waste has lost on principal and interest on defaulted loans? That money is in the future earnings of the defaulted borrowers, who instead of spending it on principal and interest to cover mortgage payments, will now spend it on rent and other necessities. And what of the lost leverage? That is being replaced by the dollars coming back into the system through de-leveraging, and which will be available for re-leveraging when it comes into stronger hands, as it must, eventually.

Further, our national debt is going to grow by leaps and bounds on account of these bailouts, and this affects our ability to repay, thus weakening the dollar further and exacerbating inflationary pressures. We are like a person who earns twenty thousand dollars a year and has two hundred thousand dollars worth of credit card balances. We have news for you. Those balances are not going to be repaid. The foreign holders of dollar-denominated assets are not stupid, and the dollar suffers in foreign exchange markets every time the debt ceiling gets raised. Our debts are accelerating. They are not leveling off. And these bailouts will put that acceleration into hyper-drive. Once the exit from treasuries begins, there will be no stopping it. The elitists want to jump-start the system so they can run the markets up again to complete The Big Sting Two, but this is a futile effort because everything else is imploding. Few can qualify for loans anymore, because the credit standards are being tightened and they are broke and overextended, and the ones who do qualify do not need it. What will businesses do with loan money when they have no customers left to buy their products? As the economy and the real estate markets continue to tank, the toxic waste will become ever less valuable, and now they want to plant that future misery in the taxpayer gardens. These bailouts must be stopped at all costs, or we are going to get vaporized later.

The system must be purged, and the dollar rescued, although we believe it is probably too late for the latter. But it is sure worth giving it a try, because having the world's reserve currency is very advantageous.

All this craziness reminds us of an old Genesis song, called "Land of Confusion." We note that our generation unknowingly, or ignorantly, helped bring the Illuminati into power, and now the Baby Boomers, who have tasted of their venomous temptations, are going to have to take them out. We know you can do it. You are our largest generation, and you have the most to lose, so you cannot, and must not, fail. All we can do now is teach you where things went wrong. It will be up to you to set things right, if not for yourselves, then for your children and your grandchildren.

.

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

letheomaniac

Adept

Gender:

Posts: 267

Reputation: 7.57

Rate letheomaniac

|

|

Re:Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #1 on: 2008-10-07 08:15:33 » |

|

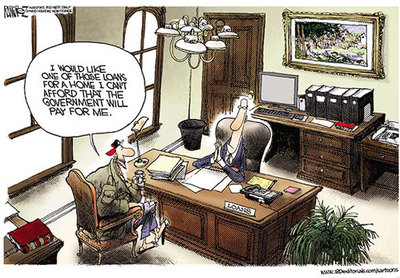

[letheomaniac] Another pungent and colourful summation from http://graphjam.com:

|

"You can't teach an old dogma new tricks." - Dorothy Parker

|

|

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Re: Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #2 on: 2008-10-14 00:30:12 » |

|

Quote:| [letheomaniac] Another pungent and colourful summation |

[Fritz]Sadly I suspect your right ... and it is so nice to see 'colour' spelled correctly

Below is Note worthy .....

Source: Dan the Man's Blog

Author: Dan

Date: Thursday, October 02, 2008

Earmarks in the Bailout Bill - Money Well Spent?

The Senate will begin debate within minutes on their attempt to revive the bailout bill rejected by the House. They have released the bill text this morning, and the Senate Conservatives Fund website has it for public perusal. The new version has no allocations going to the Housing Trust Fund, which the Dodd version originally did, so ACORN will get no money from the bailout.

However, the Senate did add a few winners to this new version:

New Tax Earmarks in Bailout Bill

* Film and Television Productions (Sec. 502)

* Wooden Arrows designed for use by children (Sec. 503)

* 6 page package of earmarks for litigants in the 1989 Exxon Valdez incident, Alaska (Sec. 504)

Tax Earmark “Extenders” in the Bailout Bill

* Virgin Island and Puerto Rican Rum (Section 308)

* American Samoa (Sec. 309)

* Mine Rescue Teams (Sec. 310)

* Mine Safety Equipment (Sec. 311)

* Domestic Production Activities in Puerto Rico (Sec. 312)

* Indian Tribes (Sec. 314, 315)

* Railroads (Sec. 316)

* Auto Racing Tracks (317)

* District of Columbia (Sec. 322)

* Wool Research (Sec. 325)

I love the auto racing tracks in particular. I can see the headlines now: “Global financial markets melt down, NASCAR, Caribbean rum hardest hit”. As many people have said now, I’d be more inclined to take this crisis seriously if people on the Hill didn’t use it to butter up their favored constituencies.

The Senate will vote at around 7:35 PM tonight on this bill. I’d expect an easier passage, thanks to provisions to expand FDIC insurance and an added authority to suspend mark-to-market rules that may make some of the rest of this bill unnecessary. Senate leadership isn’t taking any chances; they’ve added this as an amendment to a bill containing some legislation sought by both liberals and conservatives, making it difficult to oppose from any direction.

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Re:Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #3 on: 2008-10-15 20:22:52 » |

|

For the record here is the initial proposal for the 700 Billion. I imagine Section 8 is a standard clause but it does make me shake my head.

Cheers

Fritz

Source: New York Times

Author:

Date: September 20, 2008

LEGISLATIVE PROPOSAL FOR TREASURY AUTHORITY

TO PURCHASE MORTGAGE-RELATED ASSETS

Section 1. Short Title.

This Act may be cited as ____________________.

Sec. 2. Purchases of Mortgage-Related Assets.

(a) Authority to Purchase.--The Secretary is authorized to purchase, and to make and fund commitments to purchase, on such terms and conditions as determined by the Secretary, mortgage-related assets from any financial institution having its headquarters in the United States.

(b) Necessary Actions.--The Secretary is authorized to take such actions as the Secretary deems necessary to carry out the authorities in this Act, including, without limitation:

(1) appointing such employees as may be required to carry out the authorities in this Act and defining their duties;

(2) entering into contracts, including contracts for services authorized by section 3109 of title 5, United States Code, without regard to any other provision of law regarding public contracts;

(3) designating financial institutions as financial agents of the Government, and they shall perform all such reasonable duties related to this Act as financial agents of the Government as may be required of them;

(4) establishing vehicles that are authorized, subject to supervision by the Secretary, to purchase mortgage-related assets and issue obligations; and

(5) issuing such regulations and other guidance as may be necessary or appropriate to define terms or carry out the authorities of this Act.

Sec. 3. Considerations.

In exercising the authorities granted in this Act, the Secretary shall take into consideration means for--

(1) providing stability or preventing disruption to the financial markets or banking system; and

(2) protecting the taxpayer.

Sec. 4. Reports to Congress.

Within three months of the first exercise of the authority granted in section 2(a), and semiannually thereafter, the Secretary shall report to the Committees on the Budget, Financial Services, and Ways and Means of the House of Representatives and the Committees on the Budget, Finance, and Banking, Housing, and Urban Affairs of the Senate with respect to the authorities exercised under this Act and the considerations required by section 3.

Sec. 5. Rights; Management; Sale of Mortgage-Related Assets.

(a) Exercise of Rights.--The Secretary may, at any time, exercise any rights received in connection with mortgage-related assets purchased under this Act.

(b) Management of Mortgage-Related Assets.--The Secretary shall have authority to manage mortgage-related assets purchased under this Act, including revenues and portfolio risks therefrom.

(c) Sale of Mortgage-Related Assets.--The Secretary may, at any time, upon terms and conditions and at prices determined by the Secretary, sell, or enter into securities loans, repurchase transactions or other financial transactions in regard to, any mortgage-related asset purchased under this Act.

(d) Application of Sunset to Mortgage-Related Assets.--The authority of the Secretary to hold any mortgage-related asset purchased under this Act before the termination date in section 9, or to purchase or fund the purchase of a mortgage-related asset under a commitment entered into before the termination date in section 9, is not subject to the provisions of section 9.

Sec. 6. Maximum Amount of Authorized Purchases.

The Secretary’s authority to purchase mortgage-related assets under this Act shall be limited to $700,000,000,000 outstanding at any one time

Sec. 7. Funding.

For the purpose of the authorities granted in this Act, and for the costs of administering those authorities, the Secretary may use the proceeds of the sale of any securities issued under chapter 31 of title 31, United States Code, and the purposes for which securities may be issued under chapter 31 of title 31, United States Code, are extended to include actions authorized by this Act, including the payment of administrative expenses. Any funds expended for actions authorized by this Act, including the payment of administrative expenses, shall be deemed appropriated at the time of such expenditure.

Sec. 8. Review.

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

Sec. 9. Termination of Authority.

The authorities under this Act, with the exception of authorities granted in sections 2(b)(5), 5 and 7, shall terminate two years from the date of enactment of this Act.

Sec. 10. Increase in Statutory Limit on the Public Debt.

Subsection (b) of section 3101 of title 31, United States Code, is amended by striking out the dollar limitation contained in such subsection and inserting in lieu thereof $11,315,000,000,000.

Sec. 11. Credit Reform.

The costs of purchases of mortgage-related assets made under section 2(a) of this Act shall be determined as provided under the Federal Credit Reform Act of 1990, as applicable.

Sec. 12. Definitions.

For purposes of this section, the following definitions shall apply:

(1) Mortgage-Related Assets.--The term “mortgage-related assets” means residential or commercial mortgages and any securities, obligations, or other instruments that are based on or related to such mortgages, that in each case was originated or issued on or before September 17, 2008.

(2) Secretary.--The term “Secretary” means the Secretary of the Treasury.

(3) United States.--The term “United States” means the States, territories, and possessions of the United States and the District of Columbia.

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Re:Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #4 on: 2008-10-15 20:30:49 » |

|

[Fritz]Context is everything and the scaling is sobering.

Source: Voto Latino Blog

Author: Zephyr Teachout

Date: 09/22/2008

Big numbers are hard for people to process. 700 billion can start to sound like 300 billion, or 900 million for that matter. It becomes like sand grains or moon strands, magically big, past the point of counting; an amount you sit with a nephew and contemplate in wonder. Or, if you're rushing through the paper, "a whole lot." But since Congress is seriously considering giving 700 billion to be spent at the discretion of the Secretary of the Treasury, I thought I'd ask for some distributed help on describing this number to other people. Here's what I've come up with so far:

It is one third of the total amount of money received by the federal government in 2007, including social security, income tax, corporate tax, and all other receipts.

It is $140 billion more than has been spent on the Iraq war since the invasion.

It is $120 billion more than that spent on social security benefits.

It is almost 3 billion nonrefundable bus fares from Durham to San Francisco, leaving tomorrow.

It is nine times the amount spent on education in 2007.

It could pay for 2,000 McDonald's apple pies for every single American.

It is 35 times the amount spent on all foreign aid in most years.

It is more zeros than the calculator that comes with my computer allows.

It is 7,000 times bigger than the Sierra club’s yearly budget.

According to some estimates, it is three times what it would cost, over 10 years, to reduce oil dependency by 20%.

Its over twice the amount of all money given to all charitalbe organizations in the United States in any given year.

It is more than $100 for every person in the world.

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Re:Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #5 on: 2008-10-15 21:03:03 » |

|

[Fritz]More context and perspective, albeit somewhat left of centre.

Source:AlterNet

Author: Allison Stevens, Women's eNews.

Date: October 9, 2008.

Anti-poverty and women's rights lobbyists are looking at the government's $700 billion bank bailout and seeing a way to talk about national spending priorities.

"It's obviously incredibly unfair," said Irasema Garza, president of New York-based Legal Momentum, a legal advocacy group for women. "We're willing to get ourselves in that type of debt to take incredible risk to bail out those industries but as a country we're not willing to take a fraction of that particular risk to make sure we have sound economic policies to give the citizens of our country the basic things they need to live: a place to live, health care, food, education for their kids and the creation of good jobs."

In his personal blog Duncan Green, head of research for Oxfam Great Britain and author of the 2008 book "From Poverty to Power," notes that $700 billion could eradicate world poverty for more than two years.

That would disproportionately benefit women, who make up 70 percent of the world's poor, according to Washington-based Women Thrive Worldwide, a group that lobbies for aid for women in developing countries.

"It's important that we help people here who are in need and have been hurt by this financial crisis," said Nora O'Connell, vice president of policy and government affairs at Women Thrive Worldwide. "But we also have to realize that the impacts of the crisis don't stop at U.S. borders."

$150 Billion for Global Poverty

Worldwide, Green estimates that about $150 billion each year could help governments meet the United Nations millennium development goals, a global set of anti-poverty guidelines -- including gender parity in education and improved maternal health care -- laid out by 189 nations in 2000.

The Institute for Women's Policy Research, a think tank in Washington, D.C., that focuses on women and the economy, is hosting an Oct. 30 panel discussion on the impact of the financial crisis on women featuring the institute's president, Heidi Hartmann; Erica Hunt, president of the 21st Century Foundation, which focuses on economic development in the African American community; and Legal Momentum's Garza.

"We all now recognize that the economic crisis is No. 1; severe," Garza said. "But before this crisis hit Wall Street, people on Main Street were already hurting. Within that, working women were taking a big hit and have been over the last five years."

Carrie Lukas, a budget analyst with the Independent Women's Forum, a free-market think tank in Washington, D.C., said she would use the money to simplify the tax code.

"Women need a growing economy which provides jobs, especially a wide range of jobs that offer women a variety of work arrangements, and a less burdensome tax structure would certainly help toward that end."

Other advocates said they would spend the money to enhance government.

The National Family Planning and Reproductive Health Association, a lobby in Washington, D.C., estimates that $759 million -- about 1 percent of the rescue plan total -- would enable the country's low-cost health care clinics to provide all eligible individuals with the full range of family planning services: access to contraceptives, counseling, testing and treatment for sexually transmitted infections.

The government currently spends $300 million on the program.

Targeting Social Programs

On the domestic front, about $6 billion would cover the annual human, social, criminal and medical cost of domestic violence, sexual assault and stalking, according to the Washington-based National Network to End Domestic Violence. Through two major funding streams, the government allocated $573 million for programs aimed at providing service to survivors of abuse and prosecuting offenders in fiscal 2008.

Another $13 billion a year would fully fund and expand government child care programs for low-income families, according to the National Women's Law Center in Washington, D.C. And about $15 billion a year would double the number of children receiving federal child care assistance, according to the center.

On a larger scale, $90 billion would pay for a legislative package cutting domestic poverty in half over a decade, according to the Center for American Progress, a think tank in Washington, D.C. That package would expand tax credits for parents; increase college grants; provide housing assistance, food stamps and unemployment compensation; and increase the minimum wage.

Expansions in these programs would help more women than men. Women are more likely to live in poverty, more likely to lose jobs than men and more likely to have low-wage employment without benefits. Stimulating Global Economy

The bill is a good use of taxpayer money if it succeeds in thawing the credit markets and infusing cash into the global economy, said Lukas. "If there is truly a potential looming depression due to credit problems, and the investment of $700 billion can head that off, then this will be a positive investment for women."

With less wealth than men, women around the world are more vulnerable to economic downturns. If they do have jobs, women are more likely to lose them before men if companies are forced to lay off employees.

As the majority of the world's poor, women are also more vulnerable if foreign aid from wealthy countries shrinks as a result of souring economies.

"This globalized financial crisis will hit the poorest countries the hardest," said Linda Basch, president of the National Council for Research on Women, a think tank in New York. "There is justifiable concern that international development assistance will be reduced and this will hurt the poorest of the poor, who tend to be women."

A majority of female lawmakers voted for the $700 billion bailout. In the Senate, 12 of the 16 female members backed the bill; 52 of the 71 women in the House voted for passage.

"I voted, with great reluctance, for the economic rescue package," said Lois Capps, a California Democrat who chairs the Congressional Caucus on Women's Issues, a bipartisan group of female House members, "because I believe decisive action is necessary to head off what could be a huge economic calamity, one that would hurt women disproportionately."

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Re:Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #6 on: 2008-10-15 21:16:57 » |

|

[Fritz]As the worm turns .... sigh

Bailout managers may be buying own securities

Source: CNBC

Author: JOHN DUNBAR

Date: 12 Oct 2008 | 10:28 AM ET

WASHINGTON - The government's plan to make sure private managers of a $700 billion bailout plan are free of conflicts of interest is weak, according to some critics, and allows too much room for abuse.

The Treasury Department is in the process of hiring financial experts to run the giant, taxpayer-financed fund, created by the legislation that President Bush signed on Oct. 3.

The law allows the department to offer contracts that are not governed by federal procurement regulations, but requires it to draw up conflict-of-interest guidelines.

Interim guidelines released last week require applicants to disclose "any actual or potential conflicts of interest" that may come into play. Applicants must submit a plan to show how they will "avoid, mitigate or neutralize" such conflicts.

While Treasury employees will oversee the plan, there does not appear to be anything in the rules that requires the government to make sure the applicants are being truthful.

"It basically says that these companies are responsible for disclosing their own conflicts of interest," said Laura Peterson, a senior policy analyst for Taxpayers for Common Sense, a private watchdog group. "And they are then responsible for coming up with a plan to fix them. Nowhere in there does it say Treasury will also be doing due diligence."

Treasury can waive the conflict-of-interest provision.

Department spokeswoman Jennifer Zuccarelli said the government will do more than simply require the companies to identify potential conflicts. "While we ask the firms to independently identify their conflicts, Treasury then independently identifies potential conflicts ourselves," she said.

House Speaker Nancy Pelosi, D-Calif. said the guidelines drawn up by the department fall short.

"I am very concerned that they fail to meet the tough conflict-of-interest-standard directed by Congress in the legislation," Pelosi said in an Oct. 7 letter to Treasury Secretary Henry Paulson. "Under these guidelines, companies that benefit from the Troubled Assets Relief Program may also be eligible to offer asset management or other contractor services if Treasury personnel approve a mitigation plan."

The second-ranking House Republican, Rep. Roy Blunt of Missouri, said the bailout legislation rushed through Congress provides for much oversight and transparency. "Whatever the secretary does, the American people are going to get a chance to look at it," he said in a television interview Sunday.

Treasury is hiring managers for three basic tasks:

_Management of mortgage securities once the government has purchased them.

_Management of loans.

_A "custodian" for the program to run auctions, handle accounting and attend to other duties.

The job of custodian was to be awarded last Friday, according to the request for proposal, but it appears it will not happen until this coming week.

The custodian will manage the "reverse auctions" of securities, where the government will act as a single buyer and choose among multiple sellers. To get the contract a a custodian must already have at least $500 billion in assets "under custody."

Managers of the securities portfolio must have at least $100 billion in assets under management while the company that handles loans must already be managing at least $25 billion in mortgage loans or show that they can scale up to manage a portfolio of that size.

In addition to the concern over conflicts, Peterson said the government also has a generally poor track record when it comes to hiring private contractors quickly.

"There's been lots of missteps in the past," she said. "Iraq and Katrina are two very recent examples."

Government auditors have issued a number of reports critical of contracting procedures during the Iraq war and in the aftermath of Hurricane Katrina.

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Re:Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #7 on: 2008-10-19 01:38:22 » |

|

[Fritz]This goes back to where is the money going to come from .....

Source: Meltdown News

Author:

Date: October 18, 2008

U.S. Dead Broke — meltdownnews

The U.S. government is dead broke. Shocking but true. You heard it from Meltdown News first.

The much-hyped Bernanke-Paulson-Bush $700 billion bailout. Too little too late. Aside from that, the U.S. government does not have a dime of that 700 billion. Not one major media outlet has dared to point this out. The Empire wears no clothes.

That’s why as part of the legislation, Congress has to raise the statutory limit for Federal borrowing. (You can find this gingerly noted in New York Times etc.)

So where is this 700 billion coming from? The U.S. is expecting to raise it from selling its Treasury Bills to China, Japan, EU, the rest of the world.

The problem? The world is not likely to buy this time around. It’s not business as usual.

The Wall Street collapse and financial meltdown of the U.S. has finally sobered up the world. They are finally looking at the U.S. Balance Sheet. And they see only insolvency and bankruptcy.

The U.S. economic meltdown is affecting Japan and the EU too. They are sliding into recession. And China will be impacted too. As its biggest market for its exports is the U.S.

China has been subsidizing the U.S. with cheap loans. She is sitting on the motherlode of dollars and U.S. Treasury bills. And now she realizes much of the value of this cache will be lost if the dollar collapses. So at some point China must and will cut its losses.

The bottom line. The days of Japan, China, EU, and the rest of the world subsidizing the U.S. with cheap money is over.

P.S. The U.S. media — including the Wall Street Journal — refuses to report this most glaring fact in the U.S. financial crisis story: that the U.S. government is by all normal accounting standards dead broke! But not so surprising, is it? Big Media is big business. All listed on stock market and all very vulnerable to this meltdown. Murdoch et al don’t want to go out of business or speed up their own demise.

P.P.S. What will happen to the Dow when everyone sees that the U.S. can’t raise the 700 billion bailout? Next post.

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Re:Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #8 on: 2008-10-19 01:54:25 » |

|

Source: Financiarul

Author: de Florentina Gagiu

Date: 12/10/2008

Several methods of financing the undercapitalized banks from USA

Confronted with the ample crisis of the financial-banking sector, the American government had to choose among three options: to do nothing for saving the banks, letting them by their own to find solutions, or to financially support them, but without taking over the control. The third option assumed that the American state to nationalize the banks that were in difficulty. The American authorities have chosen the second alternative, through the Paulson Plan of allocating 700 billion dollars for purchasing “toxic” banking assets (without liquidities).

Paulson plan is much disputed, being considered a fiscal burden difficult of being accepted by the American tax payers. The American government hasn’t involved in helping the banking system during the Big Crisis that hit the United States of America during 1929 - 1932, the results being already known. The valid alternatives remained the financial support or nationalization of the undercapitalized financial institutions. The Japanese government has also resorted to purchasing toxic assets for ending the banking system crisis from Japan that took place at the beginning of the ‘90s. The temporary nationalization was instead liked better by the Scandinavian governments during a banking system crisis similar to the one from USA which hit Sweden, Norway and Finland at the beginning of ‘90s.

Recapitalization alternatives

When the banking system from a country steps into crisis it is necessary to be recapitalized for being avoided an excessive contraction of credit. The capitalization of the banking systems through using the public resources can take place in several ways: the government can purchase toxic assets (non-liquid), can infuse capital in preferential stocks or in common stocks, can purchase the debts of the institutions that face problems, can issue public bonds for covering the debts of banks. Moreover, there is the alternative that the financial institutions to benefit of the extended lines of governmental credit, or pure that the government to invest liquid money in the banking system. A recent study of the International Monetary Fund (IMF) which monitored 42 banking system crisis from all over the world, shows how various were solved the system problems which the banks have confronted in time. Firstly just in 32 of those 42 cases took place a financial intervention of any type from the involved governments. In those 32 cases in which the state interfered financially, just seven have included a program through which the governments have purchased assets/non-performing loans for supporting the banks, as stipulates the plan of 700 billion dollars of the USA Treasury. In 25 of those 32 cases the governments have chosen another type of intervention: in 10 cases they have purchased stocks (in six cases preferential stocks, and in other four cases common stocks), in 11 cases the state has purchased the debts of the banks, and in 12 cases has infused liquid money in the system. In two cases the banks have received credit lines, and in three cases the government has took over the passives of the institutions with problems.

Purchasing toxic assets

Even when the state has purchased toxic assets, the shareholders of the banks with problems haven’t received the dividends that were suspended, so the profits and the recovered sums from turning to account the assets were used for covering the damages. There is also the situation in which the governments have chosen to use concomitantly several methods of banking recapitalization. So, purchasing banking assets by the government rather represented the exception from the rule. Just in states such as Mexico, Japan, Bolivia, the Czech Republic, Jamaica, Malaysia and Paraguay was used this method of banking capitalization. However, even in six of these cases, the purchase of toxic assets by the governments was combined with other forms of banking capitalization, such as purchasing preferential stocks or of the debts of the institutions with problems. Japan is the only country that has applied at the beginning of ‘90s, a recapitalization method similar to the one proposed by the USA Treasury, facing so with the highest costs derived from the measures for re-establishing the banking system taken by the government. Purchasing toxic banking assets proved to be the most expensive recapitalization method.

The American model

The plan of 700 billion dollars of the American authorities, through which the USA Treasury wants to recapitalize the financial institutions with problems by purchasing toxic assets, doesn’t derive from economical realities and has no justification, Nouriel Roubini, economy professor at the University from New York and president of the macro-economic on-line publication, RGE Monitor, states.

Purchasing, with public money, toxic assets that belong to the financial systems is a “robbery”, from which will benefit only the shareholders and the common creditors of the banks supported by the American state, Roubini sustains. He thinks that the recovery of the American financial system can be achieved through using more efficient the public money, because the plan of the USA Treasury only moves 700 billion dollars from the pocket of the tax payers in the one of the bankers and investors from Wall Street. The plan doesn’t respond to the need of capital of the undercapitalized financial institutions because it doesn’t force the shareholders and the creditors of the banks to use the capital received for recapitalization.

Wasted public money

The American treasury would have used more efficiently the money of the tax payers if instead of purchasing toxic assets, it had infused public funds in the preferential stocks of the undercapitalized companies or it had completed the capital submitted to the risk (the capital of first rank) of these, not without suspending the dividends and asking to the shareholders to bring their own capital contribution. Moreover, a part of the uncovered debt of the bank must be converted into capital. All these measures would have directed to lower fiscal costs for the American government, because it would have forced the shareholders and the creditors of the undercapitalized banks to contribute to the recapitalization of the financial sector. The professor Nouriel Roubini sustains that the private sector would have contributed to the recapitalization of banks in equal measure with the funds allocated by the American Treasury, and would have been spent only 350 billion dollars from the public money, of which half were used for infusing public capital in the undercapitalized financial institutions and only 175 billion dollars were used for purchasing assets without liquidity.

Comparison

The USA government supports with money the American financial system, receiving in exchange just a share from the capital of the financial institutions which sustains. In Sweden, the government has taken over the toxic assets of the banks, but has also taken over the control over the undercapitalized financial institutions, for being able to limit the damages that affected the state budged and the tax payers. Those 700 billion dollars represent 5% of USA’s GDP, a percentage comparable with those 4% from GDP in case of the Sweden crisis. But while the Sweden government has recovered at least half of the money, for protecting its citizens of the burden of supporting the damages derived from banks, the Americans have chosen to invest money in the financial system, the same as the Japanese, without taking control of the institutions affected by the toxic assets.

The Japanese have financed the bankrupt banks with generous loans, although many of these have paid even dividends to their shareholders. The Sweden banking system has recovered in about three years, the Scandinavian banks being at the moment regarded as of the most safety ones. Japan hasn’t recovered till the present, at more than 20 years from the crisis, several Japanese banks collapsing repeatedly under the burden of the toxic assets that they have in their portfolio.

The moral hazard generates iniquities

The bankruptcy of a financial institution doesn’t mean its disappearance, Mark J. Perry, financing professor within the University from Michigan says. The bankruptcy assumes passing the ownership right of a bankrupt company from its shareholders towards its creditors. The bankruptcy penalizes the ones that have taken excessive risks and maintains in force those aspects of a business that remains profitable. In contrast, the governmental financial aid which a financial institution with problems receives, it transfers big volumes of capital from tax payers towards those who have assumed consciously the risks of granting risky credits (in case of the USA crisis - the subprime credits). So, the governmental financial support encourages the companies to have an imprudent behavior and to assume high risks, relying on the fact that they will receive public help. In this way, the “moral hazard” generates inequities in allocating the financial resources of an economy.

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Re:Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #9 on: 2008-10-19 02:00:02 » |

|

[Fritz]Still not how, but maybe who

ECONOMY-US: Terms Secret for Bank Hired to Manage Bailout

Source: Global Geopolitics Viewpoints

Author: Adrianne Appel

Date: Thursday, October 16, 2008

BOSTON, Oct 16 (IPS) - The George W. Bush administration has hired a Wall Street firm to lead its 700-billion-dollar bailout plan, but how much the U.S. is paying the firm is being kept secret.

The U.S. announced late Tuesday that it had hired global giant Bank of New York Mellon as the lead agency to help manage the spending, lending and accounting of the 700 billion dollars approved by Congress Oct. 3 for re-starting the ailing U.S. banking system.

Treasury posted its legal agreement with New York Mellon on the Treasury website but the amount of the contract was blacked out.

A Treasury spokesperson told reporters that the amount of the contract will be made public in a matter of months, after further contract arrangements with other firms have been finalised. Calls to the Treasury for a further explanation were not returned.

”I find it unbelievable we’re turning over 700 billion dollars in taxpayer money to someone else to manage but it is not being told to us how much they will be paid,” Craig Holman, a lobbyist for Public Citizen, a public interest group founded by Ralph Nader, told IPS. ”It is inexcusable.”

Earlier in the day, the Bush administration chose New York Mellon to be one of the primary beneficiaries of the 700 billion dollars. It is one of nine Wall Street firms that will receive 125 billion dollars in emergency funds, in exchange for selling non-voting shares to the U.S. government. Mellon’s portion will be 3 billion dollars, the company said.

The firm’s stock price rose 13 percent by the end of Tuesday.

”We are supportive of the Treasury’s efforts. It is time to get the markets working again for borrowers and Investors,” said Robert P. Kelly, New York Mellon chairman and chief executive officer, in a statement.

The other firms include: Bank of America, Citigroup, Goldman Sachs, JP Morgan Chase, Merrill Lynch, Morgan Stanley, State Street Bank and Wells Fargo. Other, smaller banks may apply to the government for assistance until Nov. 14.

An additional, undetermined amount of the 700 billion dollars will also likely be spent at the Wall Street firms, to purchase their bad mortgage assets, some of which are believed to be almost worthless. The firms bought and sold the risky mortgage assets and for years, made fast profits in a climate free of regulation. More recently, millions of homeowners have been unable to meet the high interest rates and in some cases, questionable demands in their mortgages, and are going into foreclosure.

Now the banks are wary of each other’s credit-worthiness, and loans among them and large businesses have slowed to a trickle. The Bush administration says the U.S. needs to inject the billions into the Wall Street firms and other banks in order to fend off a global recession.

”Our market leadership and experience have given us a keen understanding of the challenges facing the U.S. Treasury in these extraordinary times,” Kelly said in another statement, about it winning the government contract.

”We will immediately deploy our resources and expertise, joining the team of public and private organisations that are working hard to earn the trust of the American taxpayers and to address the ongoing economic challenges,” Kelly said.

Hiring one of the firms that is a target of the programme to oversee the programme raises conflict of interest questions, Holman said.

”There are inevitably going to be conflicts no matter who is brought in, and that is why oversight and public transparency is critical,” said Craig Holman, lobbyist for Public Citizen, a Washington watchdog organisation founded by Ralph Nader.

”This isn’t transparency. It is turning into another insider, Wall Street wheeling and dealing programme,” Holman said.

The two boards mandated by the U.S. Congress to oversee the 700 billion programme are not adequate, Holman said.

”One will be set up by the Treasury secretary and the Fed chairman, the same people who got us into this problem in the first place. The other is appointees from Congress,” Holman said. ”We need a third oversight board, one that requires that all records should be public.”

House Speaker Nancy Pelosi did not respond to a query about whether Congress will take action to require full disclosure by the Treasury Department of feed paid to contractors.

Congress is officially on break until Jan. 3, 2009, though the House Oversight and Government Reform Committee is holding occasional hearings on the financial crisis. Its next hearing is scheduled for November.

In a statement Tuesday, Senator Chris Dodd, chair of the Senate Banking Committee, vowed ”to play an active role in overseeing the administration’s implementation of its plans.”

New York Mellon watches over 36 trillion dollars in assets and debts for institutions and very wealthy individuals worldwide. It will perform similar functions for the U.S. government, according to the Treasury.

The firm will handle accounting and also help ”administer the complex portfolio of troubled assets the Department will purchase.” It is unclear if the firm will recuse itself from purchasing or handling its own troubled assets for the U.S. government.

”Given that we’ve seen a lot of problems with contractors for the Iraq war, it’s incumbent on the government to do as much disclosure as possible and given how many taxpayer dollars at stake,” Mary Boyle, spokesperson for Common Cause, a watchdog group, told IPS.

”There have been many instances in last decade in which there have been questions about how the feds are using contractors and what kind of accountability the contractors have. Transparency is the first step you can take to addressing these questions,” Boyle said.

This year, Bank of New York Mellon had at least two lapses in data security, involving lost or stolen data of its clients. In one incident, the social security numbers of 4 million people were potentially exposed when backup data went missing, and in another, payment documents of 50 institutional clients also disappeared.

|

Where there is the necessary technical skill to move mountains, there is no need for the faith that moves mountains -anon-

|

|

|

Fritz

Adept

Gender:

Posts: 1746

Reputation: 7.93

Rate Fritz

|

|

Re:Jump You Fuckers: Follow the bouncing 700 Billion

« Reply #10 on: 2008-10-23 08:31:42 » |

|

[Fritz]I not sure I actually understand what is being said but it does give me a knot in the pit of my stomach. from Lord Stirling Site

Source: The Market Ticker

Author: Karl Denninger

Date: 2008.10.22

America, and Americans face a stark decision - and a choice that must be made now.

Not next month at the polls, not next week.

Today.

I have been writing on this subject, petitioning Congress, and both calling and faxing Congress - and you - for the last year and a half.

We now sit literally days away, with a high probability, of a credit market "dislocation" that will change American finance and decimate the stock market.

That is, worse - far worse - than what has happened thus far.

Try on for size 2-3,000 points down on the Dow from here. 25% more than has been lost thus far, more-or-less "all at once." The probability of this event is now in excess of 70% - within the next few days to two weeks.

The Politicians know this.

They were promised that the market would not blow up if they passed Paulson's and Bernanke's bill.

They were lied to, and the first "blowup" happened.

You, the people, were promised that passing this "stabilization" bill was the right thing to do too.

You were lied to.

Now we are sitting on the edge of the second blowup - "The Big One."

Among other things, today we learned that The Fed has lost control of the Effective Fed Funds Rate - their own overnight lending rate. They were forced to change their interest rate on reserves in order to try to get it back under control - and there is no reason to believe their efforts will be effective.

The truth is that our nation, and indeed the world, has too much debt for its ability to earn income and has had since 1968. As this became apparent to the people at The Federal Reserve and Treasury, in the 1980s starting with Alan Greenspan, interest rates were artificially kept low for a long period of time to encourage you and others to go into that debt - debt you and these firms cannot possibly repay.

This is why we had the crash in 1987, why LTCM blew up in the 1990s, why we had an Internet Bubble and now why we had a Housing Bubble.

All of these bubbles were intentionally created by The Fed, Treasury and Wall Street Banks to keep the charade alive that you could take on more and more debt and they could make more and more money.

We are now out of bubbles and ability to support bubbles, and America (and the world, in fact) is out of the ability to support more debt.

We are now borrowing money to cover up the fact that millions of Americans and tens of thousands of companies are bankrupt, and the banks and other institutions that loaned them money are likewise bankrupt, as the people who owe them that money can't and never will be able to pay.

The people who in turn loan America the money it needs to operate - over $2 billion a day - have become aware of this fact.

This is very bad, because nobody will loan money to someone forever when they have no reasonable belief that they will ever be paid back.

There are only two options remaining for America, and we as Americans, and our politicians, must choose one of these two paths.

Neither path is easy.

Neither path is pain-free.

The path that will lead us to where we can prosper involves a great deal of short-term pain. It involves forcing all of the bad debt - perhaps your mortgage, the bad corporate debt, the "Ponzi-Scheme" style debt that has been layered up one on top of another - out into the open and forcing it to default.

On purpose.

This means that if you are underwater on your home, you will lose it and your credit will be destroyed for a few years. It means you may have to file for bankruptcy. It means a great deal of short term pain if you are in this position. It means that companies that have taken on too much debt will be forced to either pay down what they can, or go bankrupt if they cannot.

This path will result in higher unemployment for a time, it will result in lower standards of living. You will not be able to spend money you do not have, and neither will our government. Both the government and we the people will be forced to live within our means.

The second path is for Ben Bernanke, Henry Paulson our government and you to attempt to do what we have been doing.

That is, to borrow more money to pay the interest on money we have already borrowed. To refuse to accept that those who borrowed too much, and who can't pay, must declare that fact and face the potential bankruptcy that comes from being too far in debt and unable to make good on obligations.

This is now a critical matter for our nation, because our nation's political leaders have chosen to take the private debt of companies and individuals and attempt to guarantee it with the credit of the United States.

However, The United States is just as broke as we are individually - in fact, more so.

Treasury will have to issue three trillion dollars of new debt over the next 12 months in an attempt to make this work. But Treasury has been using very short-term debt - mostly four week and 13 week "bills", to fund the existing debt, because they are cheaper. As such the total amount of these auctions could easily reach five trillion dollars over the next 12 months.

Already, Treasury is issuing more than $100 billion dollars in this debt a week, on average, including new issues and rollovers. This is about double the total amount of debt that foreigners (or US interests) hold in total, and we have barely begun to actually issue the debt necessary to make the "TARP" operate.

We are, in effect, borrowing to pay interest. If you have ever tried to do this personally, you know that doing so almost always leads to bankruptcy.

It will for us as a nation if we don't stop it now.

Our choice as citizens is to either accept that those of us who have taken on too much debt will and must go bankrupt, declaring our insolvency and settling what we can, whether we are an individual, a corporation, or even our nation, or whether we will continue to attempt the charade of printing up more and more debt (or money) in an attempt to cover it up.

We are very close to the point where more debt causes the GDP - that is, the totality of our nation's output - to contract instead of expand.

At the point that line is crossed, our nation's monetary and economic system will fail with disastrous consequences.

This is, effectively, what happened in Iceland, and it came almost without warning. The price of everything they import tripled overnight.

We as a nation must choose, and we must do it now.

Nobody wants to accept that they cannot have a new car if they can't put down 10 to 20% of the purchase price, and that they can't "roll over" the old balance into the new loan, but that doesn't make it not true. It is, in fact, true.

Nobody wants to accept that they really need to put 20% down on a house and that houses can't sell for more than 3x incomes, on average, but it is in fact true.

Nobody wants to accept that having college cost $200,000 for four years is obscene and that allowing our kids to graduate with that sort of debt is outrageous, but it is in fact true.

Your 401k has already been turned into a 201k because our government has decided to lie about the fact that dozens if not hundreds of banks and tens of thousands of businesses, not to mention millions of individual Americans, maybe even you, are in fact broke.

Not everyone, however, is broke - but everyone's 401k, 403b and IRA is being decimated, and if we do not act now, we will all - the broke and the prudent - suffer the consequences of trying to lie about the financial state of our nation's banking system, our nation's companies and our nation's families.

We may be days away from an international credit incident originating outside of the United States. Foreign nations, banks, and businesses have "levered up", or taken more risk, than we have. They too have chosen to lie.

As money has flowed from "not guaranteed and possibly lying" firms' debt to that which is guaranteed by the government, the government has seen necessary to guarantee more and more liars, lest further firms and types of debt fail. As each type of debt becomes guaranteed it "sucks the money" from the non-guaranteed, and within weeks or days The Fed is obligated to guarantee yet another type of debt, lest it collapse too. We now have general corporate debt blowing out to wide levels, which will soon shut off all new corporate borrowing - even for sound companies - because there is no reason to buy their debt when you can buy guaranteed debt of some other type.

The Federal Reserve, starting with the "TAF", now has an entire alphabet soup of "facilities" to guarantee various debts, and the FDIC has increased its coverage. In recent weeks The Fed's facilities have even been extended overseas via "swap lines" and various other charades - it is no longer just United States interests being backstopped, it now includes foreign banks as well.

All of this is for one purpose - to cover the fact that many of these businesses are broke - that is, to cover up the lying.

But as each lie is covered up, the market calls the bluff and forces yet another coverup. The Fed is now creating new facilities to the tune of hundreds of billions of dollars they do not have, effectively displacing private lending on a global scale, now operating with leverage of more than 40:1 - all so the lies do not have to be admitted to.

But with each new charade the spiral tightens at an increasing rate.

At some point the people who have lent all of these firms money will cease to be willing to do so because all debt will become equivalent to US Debt, and all of it will be considered "dangerous."

The people who loan us money - the oil producers, the Japanese and the Chinese - are able to do the same math I am.

They know the same facts I know, and you should know.

They know the same facts that Henry Paulson and Ben Bernanke know, but have not shared in an open and honest fashion with The American People - or with Congress.

We are on the cusp of this dislocation - and this realization - being forced upon us.

I believe Treasury has been attempting to "kick the can down the road" as is the usual pattern in Washington DC.

Unfortunately the can has filled up with cement and there is now a very high probability that instead of the can being able to be kicked down the road until next year after the elections the second-level dislocation - the "big one" - is going to happen within days.

It is my opinion that we must, at all costs, protect the borrowing ability of our government - the Treasury of The United States.

We must not use our government to protect the liars in American business, no matter whether they are banks, automakers, the local store owner or ordinary Americans.

If we are to get through the difficult economic times we are in and which lie ahead, we must guarantee that our government is able to borrow money at a competitive rate.

We must make sure that the government is not lumped in with the liars, lest the government's ability to borrow get cut off or become prohibitively expensive.

This decision to differentiate the government from the liars must be made now.

Our leaders must stand up and demand that Ben Bernanke and Hank Paulson stop backstopping the bankrupt.

We must withdraw the TARP and not allow $70 billion dollars of borrowed money to go to pay bonuses at major Wall Street banks - $70 billion dollars we do not have.

We must not allow this money to be used to run mergers and other corporate "raids."

We must stop Ben Bernanke from expanding his "alphabet soup" of lending facilities, and force those who are in fact bankrupt into the open, where the free market's solution - bankruptcy - awaits.

We must force home prices down so that you can truly afford to buy a house, not keep prices artificially high so that the banks and other lenders don't lose money.

We must recognize and admit that the debt merchants - the banks - are opposed to doing the right thing not because their opposition is good for America and it is to everyone's benefit that they be protected, but because by forcing hidden defaults into the open some of them will go broke, and all of them will, in the future, have far less business to compete for.

Once the bad debt has been forced from the system then and only then should Congress step in, if necessary, and charter new banks. Spin them off to the public in IPOs with the money was going to be used for the TARP - but only after we have restored the ability of America to use credit once again by defaulting the bad debt that currently exists.

If we do not make this choice, and make it now, those who have the money we are borrowing - the Chinese, the Saudis, The Japanese and others - will make this decision for us.

They will come to the conclusion that they will never be paid back.

At this point our way of life will be irretrievably altered.

Your 401k, which is now a 201k, will become a 101k or even a 51k. The DOW could fall to below 5,000 and the S&P 500 to 500 or less, with 20 years or more of gains wiped out.

You have already seen nearly half of your money disappear.

You could see another half disappear - within days.

That is a 75% loss from October 2007 values, and before you scoff at it, look at a chart of the Nasdaq from 2000 to 2003. Our entire stock market and economy have become just as farcical as the Nasdaq was from 1995-1999. I ran a company in the Internet space in the 1990s - I saw it all, and most of the firms that failed during the Tech Wreck were more honest than the banks and mortgage lenders during the housing bubble and to this day!

The day for we, as Americans, to make this decision has arrived.

We must do so today, not after the election and not in January.

We must tell Congress now that it is critical for them to protect America's credit as a nation, not the credit of banks, business who have done imprudent things, and even ordinary Americans who have done imprudent things, whether those imprudent things were done intentionally or not.

We must make clear that we understand this will not be an easy decision, or a painless one - but it is a necessary decision, it is our decision, and it is the decision we demand they enforce as our elected representatives.

Congress must "grow a pair" and stand up for Americans, here and now, today, telling the world that these liquidity facilities will not be permitted to continue, that banks and other firms who have concealed the true state of their finances will be closed and their executives jailed if they do not immediately confess, and that house price "supports" will and must be withdrawn, including the provision of "low down payment" and "high debt-to-income" loan options.

Congress must direct Ben Bernanke to either withdraw his "alphabet soup" or Congress must revoke The Fed's charter and replace The Fed with a monetary authority that will tell the truth and act with full transparency.

Treasury must be directed to cease implementation of the TARP and return all funds not yet spent to the general fund. The short-term cash management debt that Treasury has issued must be allowed to run down and not be rolled over so that the radical expansion of issue in the Treasury market ceases and in fact is reversed.

We must choose America.

You have seen, today, another five percent decline in the stock market, despite the claims that "credit is improving."

That claim is a lie.

Credit is not improving - it is being replaced by The Fed being the only issuer and guarantor of credit - an impossible situation that is ruinous to our nation and its prospects.

We face an imminent collapse of both stock and credit markets if we do not act, and act today.

To Congress: Is there not one statesman or woman who will stand for America and her people, not for the bankers and fraudsters on Wall Street who have given you millions in campaign contributions?

To The People: You were promised a solution, and you didn't get it. Are you going to sit on your hands while our nation's economy implodes?

Those are your choices, and you must make them today.

Choose wisely.

(I hope I'm wrong, but fear I'm not.....))

Wednesday, October 22. 2008

Posted by Karl Denninger at 07:11

(Page 1 of 286, totaling 572 entries) » next page

Fiscal Cat 5 Hurricane Warning

You only think the Stock Market has been smashed.

Just wait until you see what will come next.

If you're playing "Buffett", following his claim (note: there is no penalty for lying on national television about what you're doing in your personal account) that he's buying here, there is a little ugly fact you need to be aware of.

That fact is treasury issuance.

See, to fund all this crap that Congress, Paulson and Bernanke have in the pipe (you know, the TARP, the newly-minted SIV that Ben announced this morning to buy commercial paper, etc) the treasury issue requirements will be north of three trillion dollars in this fiscal year.

Oh, and that's before Obama wins (and he will) and promises another $1 trillion worth of new spending without a nickel's worth of ability to fund it.

To put this in perspective the total amount of treasury securities owned by all foreigners at present is about $2.7 trillion.

Only a few months into this we're already requiring a crazy "tail", which is the amount of "goose" that has to be paid in order to get people to take down that debt. Its running around 20 basis points right now, and there was one disastrous auction that ran 40.

Historical norms are in the ~2-3 basis point area for off-the-run securities.

Now why does all this esoterica matter, you ask?

You've probably heard that the "IRX", or 13 week T-Bill, has come up in yield recently, and this is being touted as a clear sign that the credit markets are normalizing.

Not quite. Price and yield move in opposite directions, and when you issue a lot of short-term supply, the price goes down (supply and demand, natch), while yield goes up.

In fact, kinda like "straight up." Impressive eh?

But what's nasty here is that right now we're seeing a flight INTO longer-term bonds (the 10 in particular), which means the market is anticipating another stock panic, and with good reason.

See, Treasury has only two options here:

1. If they issue all in the short end of the curve (as they're doing now) they flatten the banks, as the entire point of a bank is to borrow in the short-term market and lend in the long term. When you compress the yield curve you destroy their capacity to make money off their ordinary business model.

2. If they issue in the long end of the curve (e.g. 10s and 30s) then the long end will skyrocket in yield. Anyone remember 18% mortgages? They could reappear. This, of course, will destroy what's left of the housing and consumer credit markets.

Now sure, The Fed can start printing money like mad and buy all these Ts, making their balance sheet expand like a balloon - or a bubble. And Bernanke, yesterday in his testimony, claimed that this didn't constitute "printing money" or "inflating the money supply."

He may be technically correct but in practice he's lying through his teeth, and unfortunately Congress is both too uninformed to call him on it and lacks the balls to stop him (which they can do through the threat of, if not actual, legislation.)

His production of money in exchange for Treasuries is nothing more than a sham sterilization action. He thinks this will go unnoticed by the markets, because he's swapping a dollar for an "illiquid" asset.

The problem is that this is only monetarily neutral if the asset is actually worth a dollar. If it is in fact worth 50 cents then he printed the other 50 cents, and devalued every other dollar in the world by the same amount.

The claim, of course, is that these assets are in fact "money good" but illiquid.

I call bullshit on that claim.

An asset is worth only what an uncoerced buyer and seller will transact at. This is first-semester economics, and Bernanke, who claims a PhD, is fully aware of that fact.

So he, like Treasury with their TARP, is effectively buying assets that are not worth what their face value indicates. In this case Bernanke gets around the inconvenient law that prohibits him from purchasing things (as opposed to "discounting a note", that is, lending) by setting up "private" SIVs run by JP Morgan/Chase (gee, Jamie Dimon, no conflict of interest there!) and then lending the funds to the SIV.

But wait - wasn't this Paulson's original SIV plan back in 2007?

It sure as hell was.

It went exactly nowhere because the banks came to the conclusion that they were being robbed; there was in fact no value equal to the claimed face in the instruments, and that plan died on the vine as a consequence.

Now, suddenly, it reappears for ABCP (asset backed commercial paper) to "liquefy" the commercial paper and money markets.

Horsecrap.

Bernanke is doing what Paulson tried and failed at in the "free" (coerced by arm-twisting by Paulson) market through executive fiat, and he is printing money to fund it. Exactly how much money he is printing (as opposed to lending) depends on the precise amount of overpayment that is being induced through these so-called "loans", but that it is happening is not open to question.

Why has this become necessary?

Ben and Hank produced a dislocation in this section of the marketplace by favoring other debt instruments with federal guarantees, thereby forcing money out of these instruments.

This in turn created major problems for money market funds who buy this paper as a routine matter of course in that when they needed to redeem deposits they suddenly found no buyers for the securities, as those people had fled to other instruments that Ben had guaranteed payment on!