Author

Author

|

Topic: Attack of the Wal-Mart-istas (Read 1388 times) |

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.30

Rate Blunderov

"We think in generalities, we live in details"

|

|

Attack of the Wal-Mart-istas

« on: 2007-08-31 16:36:47 » |

|

[Blunderov] A young man's thoughts turn lightly to armed revolution.

(This is the 2nd time I've heard that rumour about "An anonymous investor has placed a bet on an index of Europe's top 50 stocks falling by a third by the end of September". The first time was at Bellaciao whom I tend to take with a pinch of salt. Might fit in with an attack on Iran. Hmm.)

opednews.com/articles

Attack of the Wal-Mart-istas

by Stephen Pizzo Page 1 of 3 page(s)

http://www.opednews.com

Maybe I stayed in the news business for too long after my radiation badge turned red. Maybe I'm suffering from Post-traumatic, Restless News Syndrome, or something. But I have this notion stuck in my head lately. It's kind of like when I get an annoying tune stuck in my head, this notion pops up and up again, especially after I read the news.

Okay so, at the risk of exposing myself as the nut I have always secretly suspected I would someday be proven to be, here it is – my notion:

How long before before they get it? It can't be far off. So when will day arrive when America's once vibrant and hyper-patriotic working class wakes up and realizes they're at the receiving end of one of the greatest screwings in human history? And then, rather than reaching for their car keys to rush off to their second low-paying job of the day, they reach instead for one of their many guns.”

A number of things got me thinking about that. Like this story which ran earlier this week:

US Most Armed Country With 90 Guns Per 100 People

Reuters--Tuesday 28 August 2007: The United States has 90 guns for every 100 citizens, making it the most heavily armed society in the world, a report released on Tuesday said. U.S. citizens own 270 million of the world's 875 million known firearms, according to the Small Arms Survey 2007 by the Geneva-based Graduate Institute of International Studies. About 4.5 million of the 8 million new guns manufactured worldwide each year are purchased in the United States, it said. "There is roughly one firearm for every seven people worldwide. Without the United States, though, this drops to about one firearm per 10 people," it said.

Yikes. Al-Qaeda, eat your heart out. Americans have more firepower than you do. Which begs the question: when should the US movers and shakers stop worrying about al-Qaeda and start worring about al-Smith? When will all those WallMart shoppers morph into a mob of angry, well-armed Wallmartatistas?

Or is that just crazy – and me too for even considering such a thing happening in America? Maybe I am just crazy, or at least heading to Crazyland. But before you pass that judgement on me, let's run through a few of the news threads that led me down this dark and troubling path.

Item 1:

A Sobering Census Report: Americans' Meager Income Gains

The New York Times--29 August 2007: The economic party is winding down and most working Americans never even got near the punch bowl. The Census Bureau reported yesterday that median household income rose 0.7 percent last year ... (Yet) the median household income last year was still about $1,000 less than in 2000, before the onset of the last recession...And what is perhaps most disturbing is that it appears this is as good as it's going to get. (Full)

Item 2:

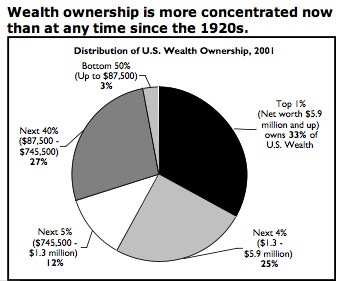

Wealth gap widens

August 29 2006: Over the past 40 years, those at the top of the money food chain have seen their wealth grow at a rate far outpacing everyone else, according to a new analysis released by the Economic Policy Institute...In the early 1960s, the top 1 percent of households in terms of net worth held 125 times the median wealth in the United States. Today, that gap has grown to 190 times.The top 20 percent of wealth-holding households, meanwhile, held 15 times the overall median wealth in the early 1960s. By 2004, that gap had grown to 23 times. "In 21st century America, wealth begets wealth, and those without wealth find it farther out of reach," the report's authors write.

Item 3:

The U.S. today - an oligarchy with inequality growing worse

The top 10% of income earners in the United States now owns 70% of the wealth, and the wealthiest 1% owns more than the bottom 95%, according to the Federal Reserve. In 2005, the top 300,000 Americans enjoyed about the same share of the nation's income — 21.8% — as the bottom 150 million...New York is an especially bleak case study. The top fifth of earners in Manhattan now makes 52 times what the lowest fifth makes — $365,826 annually compared with $7,047 — roughly comparable to income disparity in Namibia.Meanwhile, the ratio of average CEO to worker pay in the U.S. shot up from 301-to-1 to 431-to-1 in 2004. The average CEO now earns substantially more in one day than the average worker earns all year. Adding insult to injury, taxpayers actually give tax breaks to corporations for those salaries, to the tune of hundreds of millions of dollars. (Full)

Personally, I have nothing against the rich, per se. I just have this nagging belief that money in a financial system is like blood in a body. The stuff has to be fairly evenly distributed throughout the body otherwise bad things start to happen. Let the concentration get too far out of hand and the body convulses. After that all kinds of bad things can happen unless the stuff is redistributed more evenly.

One has to wonder whether the new super-rich understand that. I believe they do. Here's at least some evidence that they are getting worried the body is about to convulse.

Item 4:

Most Expensive Gated Communities 2005

NEW YORK -Exclusive gated communities that shield mansions with walls, hedges and uniformed security guards may seem like a modern phenomenon. But the notion of rich people living in protected areas is not a recent idea. "It was the line between civilization and chaos, between order and disorder," says Evan McKenzie, associate professor of political science at the University of Illinois at Chicago and author of Privatopia: Homeowner Associations and the Rise of Residential Private Government...Today, the wealthy and well-known are still drawn to private, protected neighborhoods, and are willing to pay millions of dollars--plus expensive association fees--to live in them. "The affluent always start their shopping in gated communities," says John McMonigle, a broker for Coldwell Banker International Previews in Newport Beach, Calif. "Security is more and more of a concern, especially for people moving from L.A. to Orange County. They almost always insist on gated communities. I don't think they realize what a safe little bubble it is." (Full)

Item 5:

Fortress America

: Gated Communities in the United States

Brookings Institution: Americans are electing to live behind walls with active security mechanisms to prevent intrusion into their private domains. Americans of all classes are forting up, attempting to secure the value of their houses, reduce or escape from the impact of crime, and find neighbors who share their sense of the good life. The new fortress developments are predominantly suburban, with a growing number of urban inner-city counterparts. They are, however, more than walled-off areas and refuges from urban violence and a rapidly changing society....We estimate that more than 3 million American households have already sought out this new refuge from the problems of urbanization. (Full)

So, the rich do seem to understand that at some point in process of serf-afying the American working class, that some of those newly minted serfs are likely to get a tad cranky about their diminished circumstances.

"But, the saddest part of moving to a (gated) neighborhood segregated by wealth is that your children won't have the sense of security you enjoyed growing up in a less affluent community. They won't be required to interact with young and old, rich and poor, with town drunks and with little old ladies in tennis shoes. So, they'll never feel comfortable with those who are different." (Bill Wineke Wisconsin State Journal)

Which brings me back to that first story.. the one about how many guns are out there. Who do you figure holds most of those privately owned firearms? I'd wager that 99.9% of them are owned by working stiffs. Ironic, isn't it? For decades conservative politicians have stroked working class voters into a trance with Second Amendment chants. After all, they insinuated, when the commies came, who will fight them off? Well all those patriotic, semi-automatic toting Joe and Jane Sixpacks out there, of course.

I wonder if those right wingers might be having second thoughts about that strategy? After all, millions of those now-well armed Joe and Jane Sixpack are suddenly struggling with entirely non-commie-generated problems.

Millions face foreclosure.

Forty seven million can't afford health insurance.

Tens of millions have maxxed out their credit cards and are finding it hard to even make their minimum monthly payments.

Credit-Card Defaults Rise

Wall Street Journal -- August 29, 2007: With more Americans filing for bankruptcy... credit card defaults are on the rise... According to Moody's Invester Services, credit card compaines wrote off 4.58% of payments between January and may 2007, up nearly 30% from the same period in 2006."

Each day more and more formerly comfortable working families come to realize that their kids, stuck in substandard schools and faced with diminishing career choices, are not likely to get the same fair shot at the American dream they had – if only briefly.

They are also figuring out that the infrastructure in their cities and highways is crumbling and not likely to get fixed any time soon. Why? Because the rich demanded and got tax cuts so enormous that there's no money to spend on America's infrastructure.

They are also just starting to understand that's the real reason our passenger air service has become something akin to flying Greyhound Buses – only worse -- is because America's movers and shakers have shunned commercial air for the comfort of private jets – the aeronautical equivalent of gated communities.

Working stiffs, the ones that abandoned Democrats and have voted Republican ever since Ronald Reagan blew his “Morning in America” bullshit up their asses, are slowly figuring out that they've had – big time.

Finally, whatya think is going to happen when all those hyper-patriotic, hyper-religious, hyper-armed working folk figure out that America's corporate super-rich share none of their values. Not one. They don't even see themselves as Americans any more, but as corporate citizens of the world.

Maintaining America's infrastructure – the very backbone upon which most of the super-rich built their fortunes – is someone else's responsibility. Don't tax the rich to fix all those roads and bridges upon which they continue to ship their goods and commerce. If you do tax them for it, they threaten, they'll relocate their corporate headquarters to some other tax-friendlier country.

It hasn't happened yet -- my dard vision. Maybe it never will happen. Maybe they'll figure out how to keep fooling workers into accepting and expecting less while working harder and harder. After all, "worker productivity" has become the holy grail of success. Companies are no longer judged by good citizenship qualities but by how much product they can squeeze out workers at the lowest cost. Pensions, health insurance, protecting the environment... such factors are no longer considered good corporate policy, but rather drags on productivity. So, they had to go.

I don't know, maybe I worry too much. Maybe I'm just getting old and undergoing the inevitable process that makes old farts bitch and complain about everything and anything. I admit that I do, from time to time, pine away for the America of my youth. At time between the end of World War II and the pre-Reagan era when a man like my father, who never finished high school because of the depression, was able to start his own business, work hard and attain a solid upper middle class lifestyle. He was not the exception back then, but the rule.

It was time when that carrot at the end of the stick -- the American dream -- was actually attainable by almost anyone willing to work hard. The carrot is still being hung out there, but the stick is now so long fewer and fewer can ever hope to attain the prize. Which is why fewer and fewer even bother trying.

Last month WallMart announced lower earnings expectations going forward. The company's chief financial officer noted the reason being that, “Clearly our customers are running out of money before the end of each month.”

Well, yeah. Duh.

And the US stock market convulses daily now. Some days it struggles off the floor, gives everyone a big thumbs up, only find itself face down on the floor in convulsions the next day. It's all about that blood supply being horded by that 1%.

Meanwhile in Europe savvy traders are betting on trouble.. big trouble.

Mystery trader bets market will crash by a third

16 Aug 2007--An anonymous investor has placed a bet on an index of Europe's top 50 stocks falling by a third by the end of September, as world equity markets plunged for a third day and volatility hit a three-year high. (Full)

Stephen Pizzo has been published everywhere from The New York Times to Mother Jones magazine. His book, Inside Job: The Looting of America's Savings and Loans, was nominated for a Pulitzer.

But the super-rich, sheltered behind walls and zipping above it all in Gulfstream jets see, hear and feel little of this. They are the 1% who have it all – literally. And they really don't give a fig what's going on in your lives, so don't bother whining to them about it. They've learned something the super-privileged have known down through the ages -- it's good to be the king.

In the short term those walls and gates may keep the riffraff at a distance. But I doubt they'll do much good when those millions of WallMarters grab the guns they bought dirt-cheap at WallMart and turn into angry Walmartatistas.

The history of western civilization is chuck full of instances when just that happened. Whether it happens here depends on whether someone figures out how to more evenly redistribute the economic blood supply -- and does so before blood is spilled.

|

|

|

|

|

Hermit

Archon

Posts: 4289

Reputation: 8.50

Rate Hermit

Prime example of a practically perfect person

|

|

Re:Attack of the Wal-Mart-istas

« Reply #1 on: 2007-08-31 17:48:38 » |

|

I suspect that the order of speculation above is better classified as wishful - or even wistful - thinking.

First some Facts:

Back in the early 1970s, the leadership of the US determined that the catastrophes we now face were inevitable. The Club of Rome was Right (they were wrong at the time, but it seems very likely that their subsequent actions have ensured the inevitability of their predictions of catastrophe and doom to be followed by the establishment of a bucolic planned Nirvana (populated by Americans ). At that time they also determined that a quick clean inverse decimation* of the planet was preferable to a slow and drawn out death struggle. They made their plans accordingly for a really nasty population reduction approach based on biological and nuclear weapons. These plans were classified Eyes Only, but were widely distributed. They were still active and being updated (as all active war plans, likely and unlikely are) in the mid 1990s. Some hints of these papers surfaced with the leak of NATO documents and the publication by Kissinger and other deeply embedded advisers of their opinions in this matter. Strangely, these "thoughts" seem not to have attracted much news attention in the USA.

Now a complex question with some possible, but not definite, interrelations, for the main prize:

Given the known events of the 1970s (the elimination of the Carter administration), the 1980s (the blatant looting of the Social Security and S&L funds), the 1990s (the deliberate destruction of the "new economy" and the rapid sale at firesale prices of valuable infrastructure for cash that has largely vanished from the economy), and the early 2000s (the militarization of America, establishment of large scale detention camps, concentration on chemical methods to disable and manage crowds, centralization of media and communications channels and (having learned from the collapse of the Soviets) careful separation of civilian and government communications and other infrastructure and the visibility of the vast scale of wealth transfer from the poor and middle class to the significantly wealthy and powerful), what could the rich and powerful have done or avoided that would better position themselves to survive the oncoming multiple crunces? Two recently exposed factors which may be significant in determining your reply is that the Democrats, having clearly achieved power on an opposing platform, have continued to provide enabling legislation and funding to the existing administration and also, since 1992, manipulation of the currency market has become more and more blatant, particularly subsequent to 9/11; and at this point the options are devaluation or stagflation.

And for a consolation prize, can anyone point to any significant differences between Republicans and Democrats on the issues touched on above?

For a bonus, can you tell me why I asked these particular questions? Answers to be turned in on this thread. Preferably before we nuke Iran. And you do know that is probably going to happen, don't you?

Kindest regards and no little trepidation

Hermit

*Decimation is when 1/10 of the population is eliminated. Inverse decimation is when only 1/10 survives.

|

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion. - Steven Weinberg, 1999

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.30

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:Attack of the Wal-Mart-istas

« Reply #2 on: 2007-09-01 04:11:54 » |

|

[Blunderov] An update on the "Europe's top 50 stocks falling by a third by the end of September".

More to it than meets the eye but Cassandras of the blogosphere may be onto something.

More things that make you go hmm: Tony Snow will be leaving the Whitehouse mid September...

http://www.globalresearch.ca/index.php?context=viewArticle&code=20070831&articleId=6660

Dispelling the 'Bin Laden' Options Trades

Global Research, August 31, 2007

thestreet.com

Dispelling the 'Bin Laden' Options Trades

By Steven Smith and Aaron L. Task

Staff Reporters

8/30/2007 3:23 PM EDT

URL: http://www.thestreet.com/newsanalysis/optionsfutures/10377063.html

Updated from 7:07 a.m. As if the mortgage-market meltdown wasn't enough to spook investors, some market players expressed concerns about unusual options bets that some observers have dubbed "Bin Laden Trades." The blogosphere and options trading desks have been rife with speculation about these trades, which are unusually large bets that the market will make a huge move in the next month.

Some entity, or entities, has taken a large position on extremely deep in the money S&P 500 options, both puts and calls, that won't pay off unless the market undergoes an extremely large price move between now and the options' expiration on Sept. 21. However, Dan Perper, a Partner at Peak 6, one of the largest option market makers and proprietary trading firms, has confirmed that the trades are part of a "box-spread trade." "This was done as a package in which the box spread was used [as a] means of alternative financing at more attractive interest rates" explained Perper.

Simply put, two parties agree to trade the box at a price that essentially splits the difference between current rates. For example, the rough numbers would be that given the September 700/1700 box must settle at a value of 1,000 -- it is currently trading around 997 -- that translates into a 5% interest rate. For the seller it is a way to borrow money at a slight discount to the prevailing rate, and for the buyer, it is a way to lend money at a low rate of return, but it's better than nothing at a time when others are scared and have painted themselves into a box (ha ha) because they have run out available funds. Currently there are about 63,000 700/1700 boxes open.

Perper expects that once the September options expire, you will see similar boxes established in the December series. As to why the September 700 put has over 116,000 contracts open, Perper thinks a good portion of that was created from the prior rollover when April options expired. The positions in question had option industry experts perplexed to come up with a rational explanation, which are far from the best or most efficient way to profit from what would be outlier events.

Those concerned about the worst-case scenario recalled that large put contracts were placed on airline stocks, notably American, a unit of AMR and United Airlines, in the weeks leading up to the Sept. 11, 2001 terror attacks. The first area of focus was that open interest September 700 S&P puts had such an unusually high number for such a low-probability trade. A put is a defensive bet that gives the holder the right to sell a security at a specified price, in this case more than 50% below the S&P 500's current level of 1463 as of Wednesday's close.

For comparison's sake, according to the Option Clearing Corp., the open interest in the July 700 strike some three weeks prior to expiration on July 20 was 790 calls and 7,300 puts, and the August 700 strike showed 1,250 calls and 14,800 puts prior to Aug. 17 expiration. And the volume completely outstrips anything seen last September, when the S&P was around 1300, some 20% below current levels. In September 2006, the 700 strike had 600 calls and 7,500 puts, and no strike below 1000 had open interest surpassing 42,000 contracts, and that was the 900 puts. The bulk of the September SPX trades in question have been put on since June 1.

Similar bets have also been placed on the DJ Eurostoxx 50 index, which won't pay off unless the index tumbles nearly 25% to 2800, or below, by expiration on the third Friday of September. The trades were noted in various online forums, where the worst case scenario is often the first conclusion: "Only an act of terrorism akin to 9-11 -- within the next four weeks -- could make these options valuable," writes one poster in the TickerForum chat room.

Others, such as the "Just Wondrin What Happened" blog, speculated that "China, reeling over losing $10 billion in bad loans to the sub-prime mortgage collapse presently taking place, is going to dump U.S. currency and tank all of Capitalism with a Communist financial revolution."

Furthermore, the TickerForum posters focused on the 65,000 contracts open on SPX 700 calls, ostensibly bullish bets that give the holder the right to buy the index at that level. Given the fact that these calls are some 700 points in-the-money, and therefore have a delta of 1.0 -- meaning the options price moves dollar-for-dollar with the underlying index -- "the only advantage to owning them is it would be a more efficient and slightly less capital-intensive way to gain one-to-one exposure" to the S&P 500, Randy Frederick, director of derivatives at Charles Schwab, writes in an email exchange. Frederick noted the Spyder Trust (SPY) and other index and exchange-traded products provide a much more liquid, efficient and higher-leveraged way to establish a bearish position quickly.

Plus, it's a lot easier to "hide" a big trade in the Spyders than the SPX options, which are only traded on the Chicago Board of Option Exchange and will be seen and facilitated by a tight-knit group of market makers. Because there are about half the number of open contracts on S&P 700 calls vs. puts, it was also posited that these trades are part of a large strangle. There is also open interest of 61,741 on the September 1700 puts. "Since this is only 11 contracts different from the 700 calls, it is possible that these two positions are making up a very large strangle, which could be either a breakout or neutral strategy depending upon whether or not it is a short strangle or a long strangle," writes Frederick. "If this is a short position, it may be anticipating the market will drop if the Fed does not cut rates as many expect" at its Sept. 18 policy meeting. But such a strangle trade, with each leg being so deep in the money, would require a nearly 50% price move, up or down, to turn a profit. Frederick said the position leaves him more confused than scared, although he wouldn't dismiss the frightening conclusion bloggers have come to. "It is also interesting that the anniversary of 9/11 occurs between now and the expiration of these options," he writes.

"Perhaps there is speculation that another attack is in the works." Brian Overby, director of education at TradeKing, a discount broker that caters to sophisticated option traders, suggested that this could be a box trade before Perper came forth. Overby noted that the September 1700 strike has open interest of 73,745 calls and 61,741 put options. "This could be someone trying to create a box spread, which is a position composed of a long call and short put at one strike, and a short call and long put at a different strike. The position is largely immune to changes in the price of the underlying stock, and in most cases, is a simple interest rate trade." So the upshot is there is an explanation for this very unusual configuration of open interest in the S&P 500 Index's September options, but it also shows jitters remain in this market.

Steven Smith writes regularly for TheStreet.com. In keeping with TSC's editorial policy, he doesn't own or short individual stocks. He also doesn't invest in hedge funds or other private investment partnerships. He was a seatholding member of the Chicago Board of Trade (CBOT) and the Chicago Board Options Exchange (CBOE) from May 1989 to August 1995. During that six-year period, he traded multiple markets for his own personal account and acted as an executing broker for third-party accounts. He appreciates your feedback; click here to send him an email.To read more of Steve Smith's options ideas take a free trial to TheStreet.com Options Alerts.

|

|

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.30

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:Attack of the Wal-Mart-istas

« Reply #3 on: 2007-09-01 05:25:51 » |

|

[Blunderov] Inflation is a stealth tax designed to keep the worker politically supine beneath the burden of having to make a living.

http://www.thenation.com/doc/20070910/howl

The Fed Won't Help the Working Class

Nicholas von Hoffman

Without saying who is to blame, we do know that the enabler in the subprime disaster has been the Federal Reserve Board and former chairman Alan Greenspan. Now his successor, Ben Bernanke, may make the mess even worse.

Greenspan supplied the air for the housing bubble by helping to make money so cheap and available that bankers were skulking around shopping malls sticking knives in people's ribs until they agreed to sign up for a loan they could not afford to repay.

Besides having created the mortgage-liquidity nightmare, Greenspan and the Fed can also chalk up another accomplishment: inflation. Inflation is so serious that it has more than wiped out any income gains coming to the majority of families in the past seven years.

The New York Times reports that "Americans earned a smaller average income in 2005 than in 2000, the fifth consecutive year that they had to make ends meet with less money than at the peak of the last economic expansion, new government data shows. While incomes have been on the rise since 2002, the average income in 2005 was $55,238, still nearly 1 percent less than the $55,714 in 2000, after adjusting for inflation, analysis of new tax statistics show."

In fact, the inflation damage for most families is worse than these average numbers suggest, since, as the Times says, "the growth in total incomes was concentrated among those making more than $1 million. The number of such taxpayers grew by more than 26 percent, to 303,817 in 2005, from 239,685 in 2000. These individuals, who constitute less than a quarter of 1 percent of all taxpayers, reaped almost 47 percent of the total income gains in 2005, compared with 2000."

For any individual or family, such figures translate into harsh facts at the checkout counter. Just in the last year the price of oranges and eggs has risen almost 20 percent. Milk is up more than 13 percent, chicken 10 percent, even potatoes are up more than 5 percent.

The McClatchy newspapers, where readers often get information others do not print, reports this alarming development: "The Labor Department's most recent inflation data showed that U.S. food prices rose by 4.2 percent for the 12 months ending in July, but a deeper look at the numbers reveals that the price of milk, eggs and other essentials in the American diet are actually rising by double digits. Already stung by a two-year rise in gasoline prices, American consumers now face sharply higher prices for foods they can't do without. This little-known fact may go a long way to explaining why, despite healthy job statistics, Americans remain glum about the economy."

The richer you are or the more strategically placed you are, the less you will be hurt by inflation. Members of Congress and many other high federal government personages have built cost-of-living adjustments into their pay packages; Social Security recipients have COLAs that are never bestowed on most working people so that even when they get raises they do not, as the numbers show, catch up with what inflation has already taken from them.

With a bit of luck inflation may help you. Homeowners with mortgages get a break because the money they are using to pay back their loans is worth less every year. That may not be of assistance to some people--those trapped in subprime loans, for example--who may have taken out mortgages they cannot afford.

For those of you with ever larger bills to pay with an ever smaller dollar, there is little relief in the offing. Bernanke and his Fed are under enormous pressure from the big guys to put yet more money in circulation to help the large financial institutions and distressed hedge funds get through the subprime crisis of their own making.

Thus they want him to lower interest rates, which will bring on more inflation and higher orange juice prices. But do not despair. Even during inflation some prices go down, thanks to a glut of one kind or another.

So with the news that Afghanistan has come through with a bumper opium crop, all you heroin junkies should soon be enjoying your favorite substance at less cost per toot. If you drink milk, you're outta luck.

|

|

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.30

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:Attack of the Wal-Mart-istas

« Reply #4 on: 2007-09-01 05:52:22 » |

|

[Blunderov] There must be real fright in Washington that American citizens will actually discover just how right royally they have been fucked over by the oligarchical collective. Their desperate response has been to simply invent facts and hope that nobody checks, at least not until the beneficiaries have slid off to their South American hideouts with the loot stashed safely in numbered bank accounts in Zurich.

http://bellaciao.org/en/article.php3?id_article=15615

Professional Lying

31 August 2007, 23:40:51

By David Glenn Cox

We all know this won't hurt, the checks in the mail and well you get the point, But those are the mundane lies anyone can come up with one of those. The simple lie the lie of omission but how about the whoppers the ones even the professionals in the trade lawyers and politicians shake their heads and marvel at such audacity.

Some one at the beauru of lies prevarication's and falsities deserves the golden forked tongue award. “U.S. Household Incomes Rose Last Year” Where this just your run of the mill Bush administration lie I'd let it go but it's not just a little false or even mainly false it is totally false

Personal income rose in only 8 states out of fifty and the District of Columbia but if you sharpen your pencil enough you can make it fly after all Fox isn't going to ask for any explanations. Hawaii, Maryland, Montana, North Dakota, South Dakota, little Rhode Island and Dead eye Dicks faux home state of Wyoming all gained in personal income. Notice something? These are all small or thinly populated states, would you rather have a dollar for every person in Wyoming or a quarter for every person in California?

North Dakota barely made the list with a 0.1% increase. South Dakota doubled that with a point 0.2%, Rhode Island 1.7% and Maryland 1.8% Wyoming 3.4% and that could be on Dick's income alone! But where oh where did it go up the most? Are you sure you want to know? You're not going to like it, Washington D.C. where wages went up a whopping 6.8%! You're hitting yourselves in the forehead like a Jeopardy contestant saying I should have guessed that!

6.8% in that little tiny district but what of those obscure environs where the hill people live the little state like California – 1.4%, Ohio –10.1%, Pennsylvania –4.7%, Michigan – 12.7%, North Carolina –10.1% and the list goes on and on Georgia – 8.8%, Mississippi – 9.1 %, South Carolina – 8.4% Yet the story from the government and the main stream media is “U.S. Household Incomes Rose Last Year”

The sheer volume of lost dollars by the American worker should prompt us to rename the upcoming holiday weekend as Screw You day! Or perhaps Suckers Memorial Weekend.

In Indiana it amounts to $5000 per household in Illinois $4300 Iowa $ 3200 but income is up .1% in North Dakota! The true decline in personal income or the shifting of income out of the middle class explains the sub prime mortgage woes As there are fewer qualified homebuyers. Globalism has brought the ability to exploit cheap labor from over seas bringing wealth to a few and poverty all around. Gradually destroying the underpinnings of or society. The figures don't lie but the liars figure real wages were less in 2006 than they were in 1999.

Want a new reason to remove George W. Bush? Incompetence is a legitimate reason! We the people of the United States, in order to form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity, do ordain and establish this Constitution for the United States of America.

Does this sound like insuring domestic tranquility in a more perfect union? Or promoting the general warfare? If the fiscal policies of a President show nothing but a detriment to the American populace isn't it that President's sworn duty to correct that?

But aside from the wars and the lies and the corruption and the smoke of Bush administration is hidden that the money supply has doubled in six years. Not only has personal income declined but also the value of those reduced dollars has shrunk as well. The world knows it and the bankers know it and the American family knows it but to the Fox news crew and the mainstream media, Good News, “U.S. Household Incomes Rose Last Year.”

|

|

|

|

|

Blunderov

Archon

Gender:

Posts: 3160

Reputation: 8.30

Rate Blunderov

"We think in generalities, we live in details"

|

|

Re:Attack of the Wal-Mart-istas

« Reply #5 on: 2007-09-01 07:08:15 » |

|

Quote from: Hermit on 2007-08-31 17:48:38

...For a bonus, can you tell me why I asked these particular questions?... |

[Blunderov] My guess is that Hermit is pointing out the urgent need for a 3rd political option (well, a 2nd really) in America before World War 3 begins.

Given the precautions which have been taken against just this possibility, it probably means that WW3 will commence shortly.

Alea jacta est.

|

|

|

|

|

|